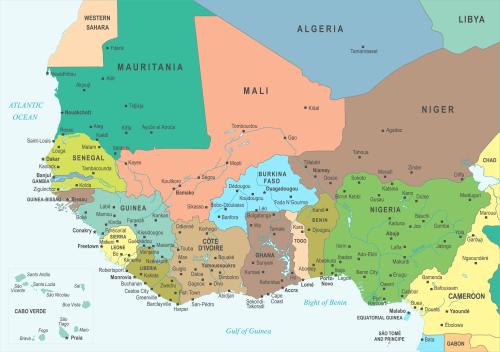

Comprising many of the poorest countries in Africa, including those in the Sahel, the CFA franc zone faces particularly daunting challenges to economic development and growth in the context of the ongoing COVID-19 pandemic.

Encompassing 14 countries in francophone West and Central Africa, the CFA franc zone faces climate change, poverty traps, demographic pressures, and natural resource management hurdles. Furthermore, the trifecta of high energy costs, financing constraints, and expensive transport creates barriers to competitiveness. In addition, despite decades of international aid flows, the region has struggled to gain the upper hand in reducing poverty. The COVID-19 pandemic has further amplified the challenges faced by the countries of the CFA franc zone and has simultaneously led to questions about the fiscal and monetary policies most conducive to driving recovery and growth as the world economy adapts to post-COVID-19 market realities.

Since the 1940s, the CFA has been pegged to European currencies—first to the French franc, and, since 1999, to the euro. Until recently, the CFA countries deposited 50 percent of their reserves in the French Treasury in return for a convertibility guarantee. While this arrangement generally resulted in lower inflation than other countries in Africa and some degree of fiscal restraint, it significantly limited the macroeconomic policy options available to its member countries. The trade-off for lower inflation has been slower per capita growth (Figure 1) and diminished poverty reduction.

However, the current exchange rate regime presents several macroeconomic problems that impede these countries’ ability to navigate the COVID-19 pandemic. First, the anchor to a strong currency diminishes private sector competitiveness by effectively subsidizing imports and penalizing exports. As measured by a simple CGE model, in 2020 the CFA franc in the West African Economic and Monetary Union (WAEMU, or UEMOA in French) was 20 percent overvalued, and in the Central African Economic and Monetary Community (known by its French acronym, CEMAC) it was 30 percent overvalued. Second, exchange rate rigidity forces adjustments to trade shocks on the fiscal side via cuts to public investment or additional debt accumulation. Third, the current system worsens inequality between urban elites and rural poor by constraining incentives for commercial agriculture. Fourth, since the monetary policy is fixed, the CFA countries face credit constraints and are unable to use interest rate policy to stimulate small and medium enterprise development. Finally, the currency union has failed to accelerate growth for the poorest members as seen in the lack of economic convergence over time (Figure 2).

As the CFA member countries plan for a post-COVID-19 future, taking the next step on meaningful currency reform must be part of the package. Specifically, while the Macron-Ouattara reform of 2019 ended the reserve deposit obligation and removed French representatives from the Central Bank of West African States (known by its French acronym, BCEAO), it stopped short of overhauling the exchange rate framework. Modernizing the system must include a serious discussion about alternative exchange rate frameworks that would enable greater monetary flexibility while improving competitiveness, opening the door to export-led growth, and realigning incentives for agricultural producers.

For more on this issue, see my book, “CFA Franc Zone: Economic Development and the Post-Covid Recovery,” in which I lay out a policy road map with a number of steps. First, the exchange rate regime should evolve from the peg to the euro, to a basket (tripartite) peg to the euro-dollar-renminbi that reflects West Africa’s changing trade patterns with the world. For CEMAC, which is an oil-rich region, I propose a peg to a basket, including the euro, dollar, and price of oil. This reform will balance stability and flexibility, make the currency more market-based, and support African exporters and entrepreneurs. In the CEMAC zone, it will help the countries adjust to oil price volatility, while in the WAEMU zone, the countries can even embrace integration with specific anglophone countries like Ghana and create a stronger economic space. Second, it is important to modernize the French convertibility guarantee for the CFA franc, which is unclear, and negotiate a clear swap line with the European Central Bank to provide a financial buffer during the transition period and downturns.

Finally, the ultimate goal of the reforms is to have greater African sovereignty and widen the options for fiscal and monetary management in a post-pandemic world. A richer and more prosperous CFA zone will be beneficial not only for West and Central Africa but also for France and the world at large.

Commentary

CFA franc zone: Economic development and the post-COVID recovery

August 5, 2021